December 21st is officially the first day of winter.

Because of the energy market’s volatility throughout the winter months, it’s important to understand what factors influence these large market swings so you can be prepared to make the right decisions that insulate, protect, and capture lows for your business’s electricity and natural gas contracts.

What elements are the largest determinants of electricity and natural gas prices in the winter months?

Supply and Demand

Supply and demand is a fundamental driver of prices for any commodity, especially electricity and natural gas. The need or demand for energy changes from season-to-season with winter and summer being the most demand-heavy on the grid:

- Summer: Buildings are using more electricity to cool down with air conditioning units

- Winter: Buildings are using more electricity and natural gas to warm up with heating units

When demand increases, there is obviously more electricity needed to be produced and distributed throughout the grid, which raises the price of it. What may not be obvious, however, is that electricity demand also impacts the price of natural gas due to it being one of the most popular fuel sources for electricity generation.

Did you know that natural gas is one of the top fuel sources for generating electricity in the United States?

When demand for natural gas rises, prices rise with it. This increases the cost of producing electricity which in turn increases the price energy buyers pay for it.

Electricity generation plants that use natural gas are also the reason that the electricity and natural gas market move in line with each other, especially in New England. This is one of the many reasons natural gas storage reports are important to keep a pulse on!

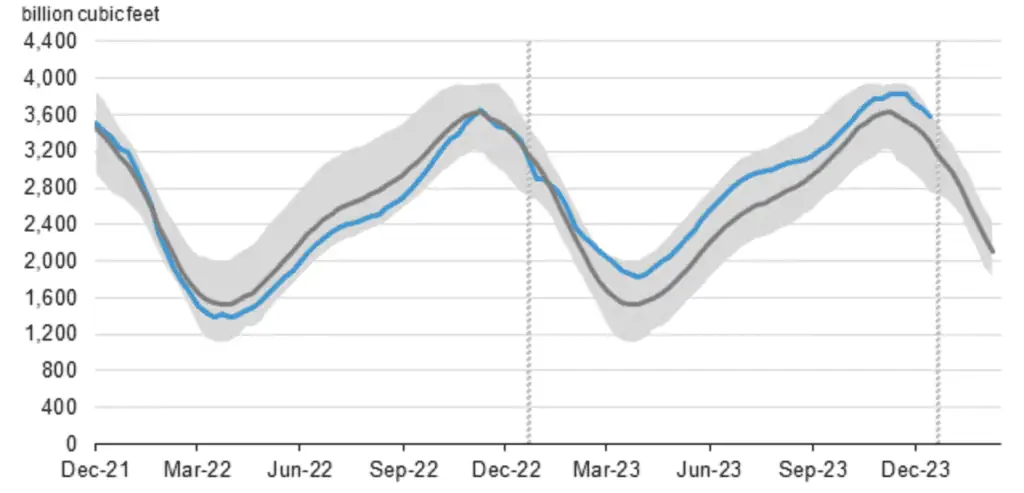

Natural Gas Storage

When more natural gas is produced than can be used in the country, it ends up being stored in underground caverns, to be used when needed. When storage gets full, it is a signal to the market that there is plenty of supply. This puts downward pressure on prices.

If the winter ends up being very cold, demand will increase and we will start to burn through what we have in storage. If there is no production happening during these months, more upward pressure will be added to natural gas prices.

Basis Differential: The Transportation of Natural Gas

Another huge driver of natural gas prices is one of the two main price components that make up your natural gas supply price, the Basis Differential or Basis for short.

Basis is the cost difference of moving natural gas between two different points, typically the Henry Hub where the NYMEX futures contracts are delivered and your local market area such as Algonquin City-gate (New England, Transco Zone 6 New York, or Chicago Citygate.

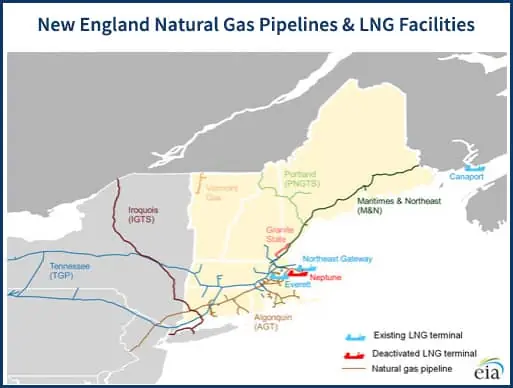

Whether it’s consumed by a power plant, factory, or user, a network of natural gas pipelines moves the fuel throughout the country to deliver it to its final destination.

The Basis price is reflective of the difference between each market’s supply/demand equation. In a region like Pennsylvania in which there is a lot of local natural gas production, the high supply tends to push prices down. However, regions such as New England do not have any local natural gas production and only two major pipelines moving gas to the region, Algonquin (AGT) and Tennessee (TGP).

This, coupled with the region’s large & dense population, creates a lot of demand during harsh winter weather. As the demand for gas grows, upward pressure is added onto gas prices for generation as well as heating. In order to keep prices in check, new supply needs to come into the market – either from local production or via new pipeline delivery. If it doesn’t, Basis prices can increase substantially.

Volatile Winter Weather

As you can see, there are a lot of factors that impact the cost of energy in the winter. The commonality between all of these mitigating factors is demand. So, what impacts demand the most? – Winter weather!

Winter Forecasts

One major influence on prices during the winter is the weather forecast. Electricity and natural gas are traded so predictions and forecasts dictate market movement. This is called ‘speculative pressure.’

If forecasts predict a really cold winter, trading increases and pushes the market up. If predictions arise for a mild winter, trading decreases and pushes the markets down. This impacts both the futures market for prices years ahead as well as the daily spot market price used with index pricing strategies.

Even though weather forecasts made are never fully accurate, the mere threat of colder or warmer weather will still heavily impacts the markets.

For a more specific outlook on how this winter’s weather will affect your current and future energy contracts, contact us today!