The right cost saving purchasing strategy for your business is dependent on a multitude of factors.

These include your business’s energy usage, operations, risk tolerance, and budget needs. Without a tailored purchasing strategy, you could miss opportunities to capture market lows on your gas or electricity plan. This could also force your business into paying volatile market prices for the entire length of your energy contracts!

Your electricity and natural gas supply prices are made up of multiple components. Each component requires an intelligent purchasing strategy to maximize the full cost avoidance potential of it. One of the components that can benefit the most from a refined strategy is the actual electricity or gas commodity.

Before embarking on your electricity and natural gas procurement, it’s vital to understand the 3 basic types of purchasing strategies that underpin the customization of your natural gas and electricity plans: Fixed rate, Index and Blended.

Fixed Pricing Strategies for Natural Gas & Electricity Plans

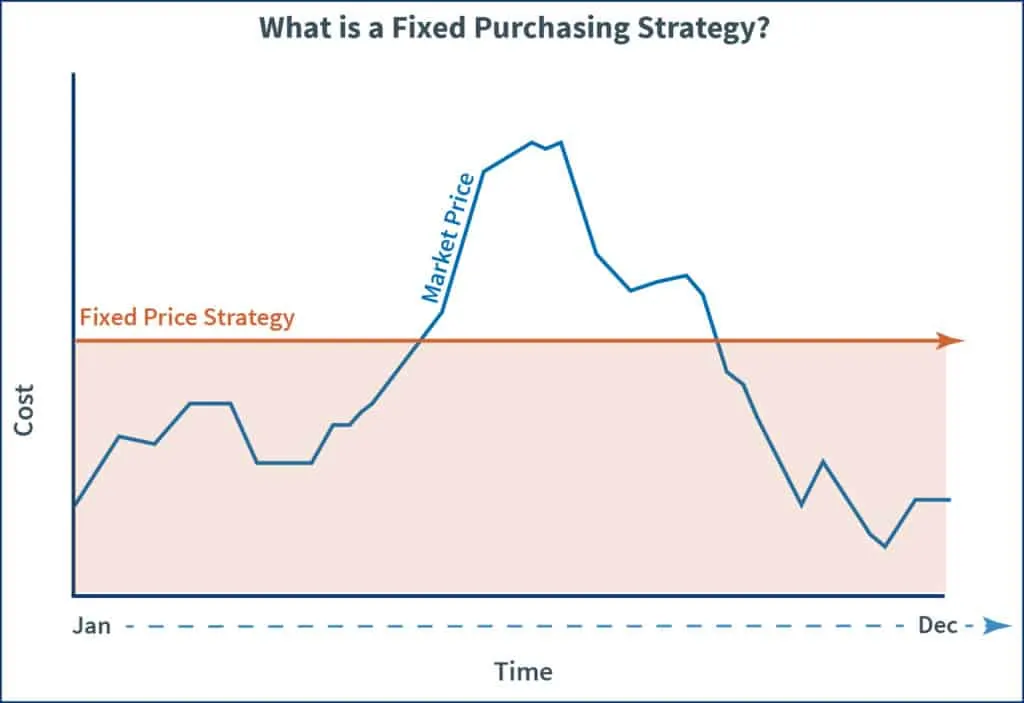

A fixed rate electricity plan is the most common type of purchasing strategy. Here you secure a price per kWh at a point in time for 100% of your contract.

There are many benefits with using fixed pricing strategies on your natural gas & electricity plans. This is because they are simple to manage, provide cost stability to protect your budget, and allow for budget predictability. We use data-backed market timing techniques with fixed pricing strategies to identify both advantageous and inopportune times to purchase.

Fixed pricing is considered one of the ‘safer’ strategies for gas and electricity plans. This is due to the substantial protection from price volatility. However, fixed rates are not without their own risks.

The danger with this type of purchasing strategy comes with missing out on capturing low prices. These missed low prices come from declining markets, rate changes based on usage changes, and multiple other factors. These factors can all lead to higher overall costs for your entire energy contract length.

Indexed Pricing Strategies for Natural Gas & Electricity Plans

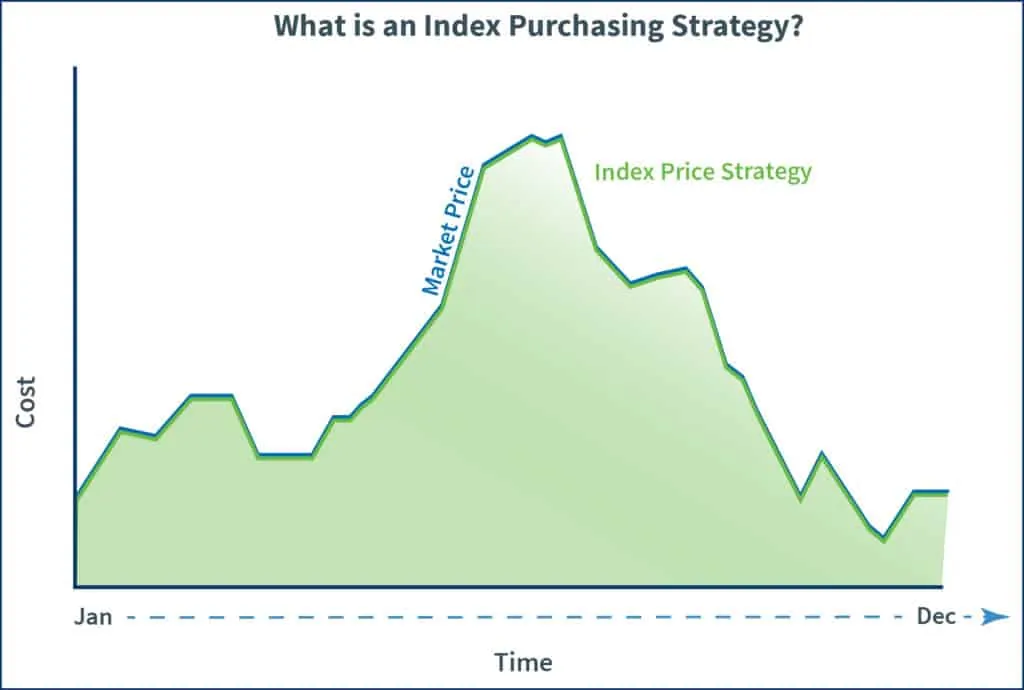

With an index pricing strategy, you float a percentage of your gas or electricity plan on the market. This would have you paying a varying monthly settlement cost.

There are many benefits to index pricing strategies for natural gas and electricity plans. Index pricing is the polar opposite of fixed pricing as it provides flexibility to take advantage of opportunistic market conditions. It also affords the potential to capture significant market lows from monthly settlements. Because you’re automatically capturing lows while the market fluctuates, there is a lot of cost avoidance potential with index pricing.

There are also more cost avoidance opportunities for businesses using energy off-peak hours or who can adjust their energy consumption. Businesses who have loads that suppliers deem as ‘risky’ also frequently employ this type of pricing.

Because the market is constantly changing, there is the potential for higher price volatility with index pricing. For example, the market could swing upwards and sustain that trend, which would increase the monthly settlement cost.

Blended Pricing Strategies

A blended pricing strategy is a combination of both fixed and index pricing. These strategies fix part of your contract cost per kWh. The remaining open positions of your contract are floated on the market paying the monthly settlement price. With this type of strategy, you could lock-in as little as 1% of a price component for your entire contract. The percentage you fix or float is up to you and dependent on the risk tolerance of your business. To get the most out of this type of strategy, however, you should listen to your energy broker’s guidance.

An Example of Blended Pricing

For example, if the market hit an all-time low, you would fix a portion of your commodity contract. If the market hit a low, but we predicted it would drop more, you would fix a smaller piece. You would also index the remaining percentage to ride out the predicted lows. This would allow you to leave more of your contract open to capture even lower prices in the future. If the market was rising, you would wait on purchasing the open positions until the market dropped again.

The end result of these strategies can actually be a fixed rate. You would accomplish this by hedging different portions of your contract until the entire portion of it was fixed. Like the example above, you would do this by timing the market and hedging portions when it dips.

This type of pricing provides the best of both index and fixed pricing strategies. This is because it provides cost stability and predictability while allowing the flexibility to capitalize on market changes.

The risks for blended pricing are the same volatility risks as index and fixed pricing, albeit on a smaller scale.

The Opportunities of Blended Pricing Strategies

There is a great deal of opportunity when customizing this type of purchasing strategy to your business’s needs. For instance, you could fix/hedge a portion of your load during the day and index at night. This would leverage your daily consumption patterns as well as take advantage of the market being less unstable at night.

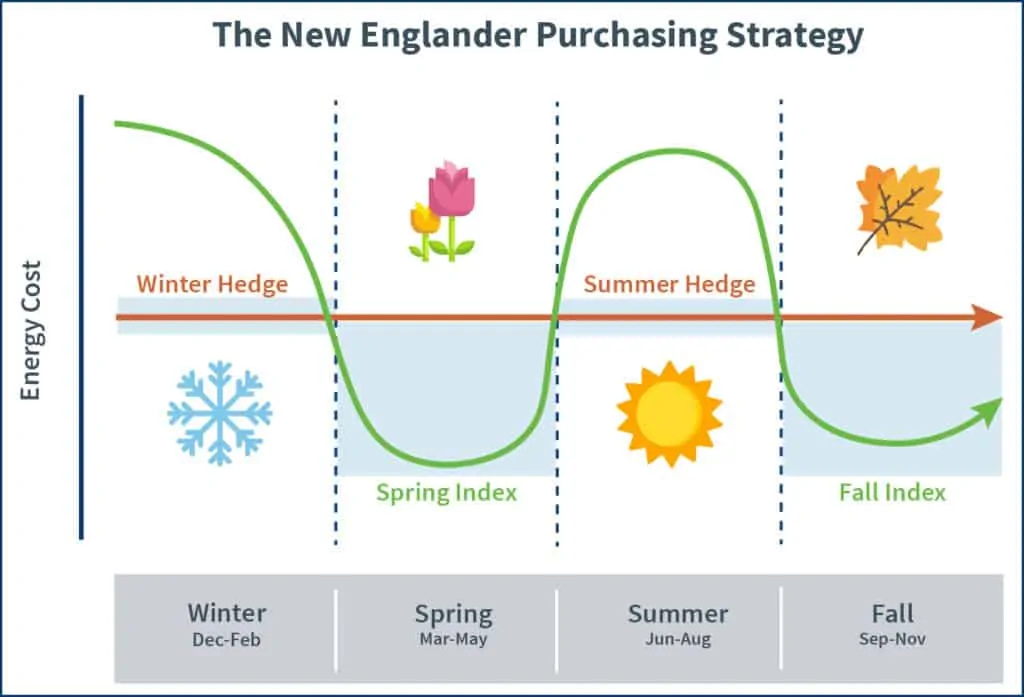

One type of customization we commonly do with blended is a seasonal purchasing strategy referred to as the New Englander. With this strategy, you would hedge/fix a good price for the volatile winter & summer months. For the spring and fall you would index your price to capitalize on less erratic market conditions. We named it this because winter prices in New England are some of the most inconsistent throughout the country!

The Importance of Customized Purchasing Strategies

When it comes to purchasing electricity or natural gas, there is no one-size-fits-all approach. Every business requires their own customized purchasing strategies that are adhered to their operations, budget goals, and KPIs.

Many brokers simply recommend fully fixed price contracts to their customers. This is an antiquated way of purchasing energy that does not lead to cost avoidance on your bills. While fully fixed contracts are suitable for many companies with strict budget rules, they are not best for all businesses.

Our Energy Advisors work closely with you to gain a full understanding of your business. We then educate you on different approaches and customize a purchasing strategy to your business and budget needs. The end result is a tailored strategy that maximizes the value and cost avoidance potential of your contracts.

Choosing the right purchasing strategy is just the first step in your energy procurement. To discover more about what goes into our meticulous contract design process, check out this blog post.