Intelligent & tailored hedging strategies are key to helping your business save on energy!

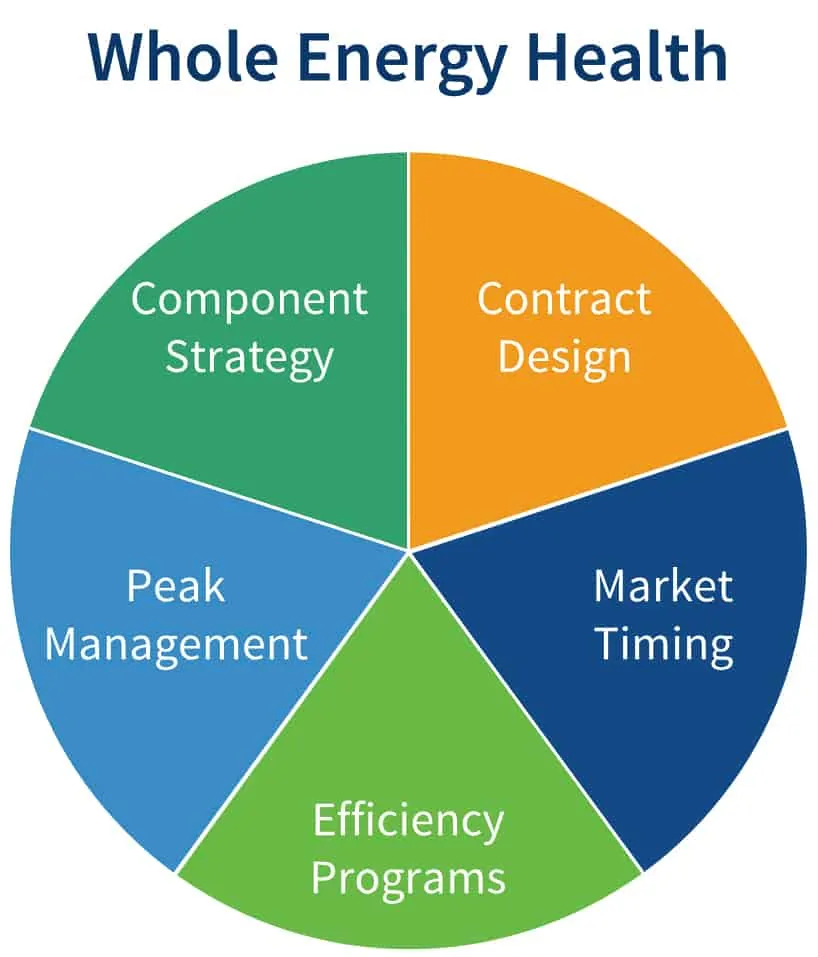

Our turnkey energy management solution, Whole Energy Health, consists of 5 tenets. Each tenet uses strategies customized to your business that are aimed at avoiding costs on your energy bills. One of these tenets is Market Timing. This one employs an energy hedging strategy that we call Runway Management. With this hedging strategy, we build your future energy contracts in increments over time to identify and capture market lows while insulating you from price spikes.

Watch the video below to learn more about Runway Management and how it can help your business get the most value out of your energy contracts.

Hedging Strategies Made for Your Business

Are your energy costs weighing down your budget?

By changing how you purchase energy, you can easily optimize your next energy contract. All you have to do is capture 1 or 2 market lows before your next contract’s start date! Compared to traditional buying methods, purchasing this way increases costs avoidance by 18%!

Welcome to Best Practice Energy’s Runway Management, a hedging strategy made for your business. This hedging strategy is an aspect of the market timing piece of our turnkey energy management solution, Whole Energy Health.

Hedging strategies are a calculated way of purchasing energy that energy suppliers and providers in deregulated regions offer. They are a method in which energy brokers like us build a future contract in small increments or hedges over time.

Why Do We Call it Runway Management?

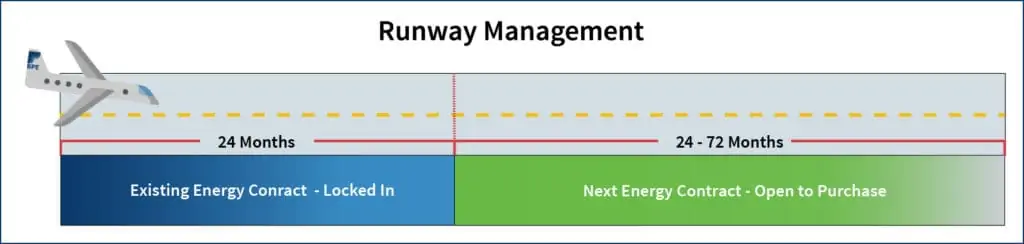

Think of your energy contract as a runway. The part of the runway you are currently on is your existing contract. However, you still have an open contract to fill that might not start for a year or two! This open contract is the latter part of your runway that you haven’t reached yet.

We focus on capturing pieces of that future contract on your runway!

Over time, we lock in market lows to build your future contract piece-by-piece. A proactive hedging strategy like this allows us to take advantage of future markets which are less volatile the further out you buy.

To determine opportune times to purchase these contract pieces, we put every client on a customized ‘market watch.’

What is a Market Watch?

A ‘market watch’ is exactly what it sounds like: we watch the energy markets closely every day to identify smart purchasing opportunities. When these opportunities are identified, we capture them and lock them in for a portion of the energy contract. This ensures businesses are insulated from volatility while capturing market lows.

As you can see below, the difference between buying at a bad time vs an opportune time is about 33%!

When building a contract this way, our energy advisors are informed by a plethora of data and proprietary algorithms. These include Liquified Natural Gas (LNG) exports, NYMEX market, the economy, legislation, historical price patterns, weather forecasts, ISO Locational Marginal Price (LMP), and much more.

In short, our energy advisors do all the market timing and hard work for you! This is because we take the reins of your energy contract so you don’t have to worry about it. We will contact you periodically to let you know what we predict and see, but all the heavy lifting is on us!

Knowing that your next contract is already optimized and your budget secured, you can relax and focus on the rest of your job!

There is no better time to start working on your future energy contract than today!

Contact us to learn more about Runway Management and how our energy management solutions can help you reduce your energy bills.