With a new focus on sustainability, how could the cost of renewable energy and energy legislation impact retail energy prices?

So far in 2021 the US has seen a new president take office as well as the democrats take control of the senate. This shift at the federal level has turned an eye onto renewable energy laws. At the state-level, renewable energy goals have been on the upswing for years. On top of that, we’ve seen the private sector start focusing more on renewable energy. With these changes coming down the pipeline, the cost of renewable energy and its infrastructure could have implications for retail energy prices.

What is happening with renewable energy in the US?

At the federal level, experts and analysts believe that the government shift could lead to more aggressive carbon reduction policies. Many also believe that more money may be allocated to renewable energy developments. The United States is not alone here as much of the world is heading in this direction.

With these changes happening to renewable energy, how could residential and commercial energy contracts be impacted?

Read on to find out!

Biden’s Federal Renewable Energy Plan

Back in July 2020, now President Biden overviewed a plan to allocate $2 trillion to infrastructure. One of the main aspects of this plan is renewable energy.

President Biden wants to invest in renewable energy for a variety of reasons. These include creating more jobs, more energy-efficient public housing, and more electric vehicle charging stations. However, what is most notable is that he plans to put an end to electricity generated from carbon sources.

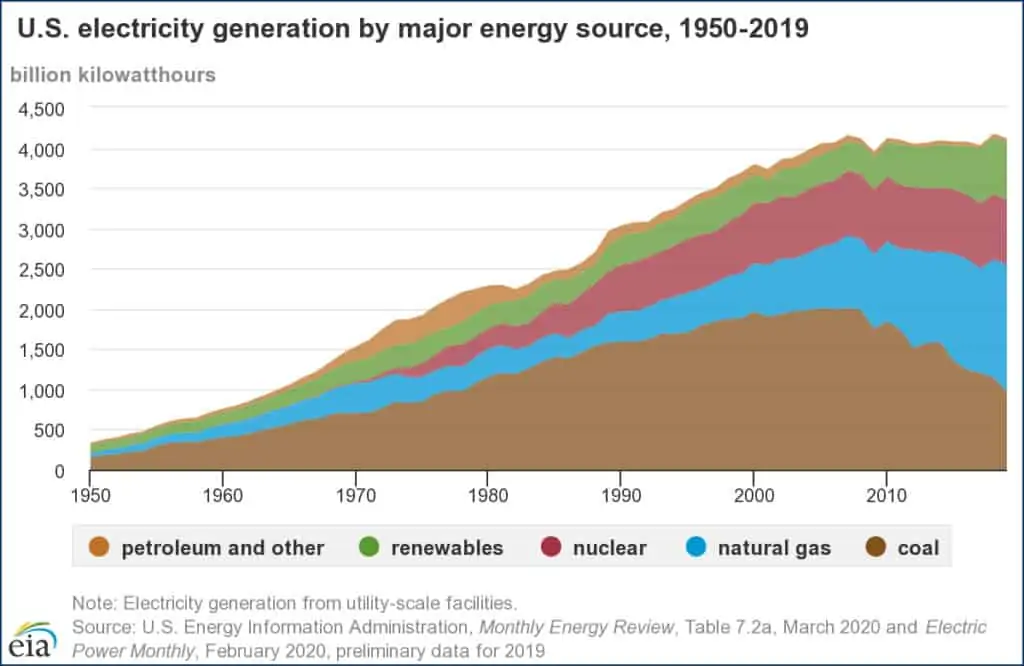

In 2010, renewable energy was responsible for 427 billion kWh of all US electricity generated. Nine years later (2019), renewable energy accounted for 728 billion kWh or 17.6% of all electricity generated. That’s a 70% increase!

Congress’ Plan for Renewable Energy

Another potential factor in new renewable energy legislation is the now Democrat-controlled senate.

In August 2020, Democrats in the Senate laid out recommendations for Congress that would give the United States a net-zero carbon economy by 2050.

The senate is now Democrat-led with Senate Majority Leader Chuck Schumer (D-NY) in charge. In December of 2020, Schumer was already discussing green infrastructure legislation with then President-Elect Biden.

Renewable Energy Increases in the Private Sector

The federal government is not alone in putting the spotlight on renewable energy increases. From 2018 to 2019, US private investments in renewable energy projects increased by 21% ($58.4 billion).

Many US states have also been adding aggressive renewable energy goals. In fact, 38 states have some type of clean energy goal, 9 of which are aiming for 100% renewable energy by 2050.

How will new green energy investments along with the cost of renewable energy impact the price of electricity?

The fuel used to generate electricity from renewable energy is cheaper than conventional methods. This is an obvious statement as you don’t have to pay for fuel from the sun or the wind! If more renewable energy is used for electricity generation, the wholesale price of electricity may decrease. However, it’s more expensive to transmit renewable energy throughout the electricity grid. New renewable energy infrastructure is another expense that adds up as well.

So, while the wholesale price of electricity may decrease, other renewable energy costs may trickle down and increase retail electricity prices.

Another factor to consider in cost spikes is the Renewable Portfolio Standards (RPS) component of an electricity supply price.

Renewable Portfolio Standards

Renewable Portfolio Standards (RPS) is one of several components that makes up an electricity supply price.

Essentially, Renewable Portfolio Standards is a specified percentage of the electricity sold in a state that must come from renewable resources. The federal government does not have anything to do with RPS expenses as they are a state government-mandated expense.

Renewable Portfolio Standards do not exist in every state, however, they do exist in 31 states as well as in 3 US territories. Seven additional states have some sort of voluntary renewable energy standard or target to hit as well.

For ISO-NE, NYISO, and PJM Interconnection regions, the state Renewable Portfolio Standards vary in both percentage as well as name. Take a look at the images below to see each ISO/RTO region’s Renewable Portfolio Standards goals.

As Renewable Portfolio Standards goals increase in the states outlined above, more renewable energy infrastructure will be needed to reach those goals. This, coupled with the federal goals to eradicate fossil fuel generation, we are looking at a green revolution.

How Will the Cost of Renewable Energy Impact Retail Energy Contracts?

It is not known how these federal, state, and private renewable energy changes will impact the retail price of electricity. While increases may seem likely, the industry is pretty split on the matter.

The question is, what can businesses do to protect their electricity contracts if increases do come?

Energy Brokers and Consultant Help Protect Energy Contracts

By having an energy broker optimize their energy contracts, businesses can insulate themselves from price increases.

Best Practice Energy did exactly this a couple of years ago for our Massachusetts clients.

In 2018, new legislation threated to raise the Renewable Portfolio Standards percentage of Massachusetts businesses’ electricity loads. Because we are always watching potential factors that could impact the energy markets, we saw an opportunity to strategically lock-in the RPS component for impacted clients before the law went into effect. This gave them a few years of insulation on their contracts before they had to pay the increases.

A Note About Clean Energy Goals and the Cost of Renewable Energy

With all these aggressive renewable energy goals, it should be noted that:

A. States can change their goals.

B. States may not reach these goals during these timeframes.

C. No one knows for sure what impact everything will have on energy prices.

What businesses can do is ensure that their energy contracts are optimized with a regulatory strategy that will lock-in prices if spikes do happen.

The Coming Green Revolution

The bad news: Whether federal or state, energy legislation is extremely complicated and very difficult to follow or fully understand.

The good news: Here at Best Practice Energy our job is to take control and optimize energy contracts so business don’t have to worry about how new laws will impact prices!

With a new administration, state goals, and focus from the private sector, the green revolution seems imminent for the US. These factors, coupled with the cost of renewable energy, will impact retail energy prices in some way.

In times of change like this, it is important for businesses to have a partner who will take the reins of their energy contracts and optimize them. This ensures the energy contracts are providing the most value possible and are insulated from price spiking volatility with a bulletproof regulatory strategy.

Contact us today to find out more about your state’s Renewable Portfolio Standards goals. We will design a regulatory strategy for your business that optimizes your contracts so they are protected from price increases.