Electricity prices in New England are some of the most volatile of the entire country.

While they change constantly on a minute-to-minute basis everywhere in the United States, the standard deviation between the highs and lows of New England’s prices is significantly greater. This is due to a whole host of factors, the most notably being our erratic weather and the price of natural gas.

This unstable market movement actually presents a great opportunity to capture low prices for energy buyers if you have the right energy consultant timing the market for you!

A Meeting That Changed Everything

In December of 2014 Best Practice Energy was barely 4 years old. We were still helping businesses avoid unnecessary electricity and natural gas costs with our Whole Energy Health approach to procurement, but we didn’t even have a name for it yet! However, we still knew that there was no one-size-fits-all approach to purchasing energy and that the key to achieving cost avoidance on energy bills was through tailored strategies.

We met with the controller in charge of energy procurement for a metal manufacturer. Even though they were unhappy with their contract, they planned to renew with their broker just a month before their contract was up. At this time they realized that the only rates they could capture were extremely steep as the next three winters (2014/2015, 2015/2016, and 2017/2018) were trading at all-time highs.

By the time we started talking to this manufacturer, they were planning to lock in an all-in fixed contract in the $0.12 range! In other words, they were in desperate need of a strategy.

As always, we performed a free consultation on their electricity contract to help them understand what type of cost avoidance they could achieve by using us as their energy consultant.

Impressed with what we had to offer, they decided to sign with us for their next electricity contract. We ended up designing a purchasing strategy for them that broke the calendar year up into seasons and attacked each one differently.

Through a series of hedges over the course of their entire contract, this manufacturer was able to cost average down and save $0.03 per kWh a year on average or $90,000 annually. They ended up saving over $270,000 throughout the whole contract!

How exactly was a seasonal-approach able to elevate the value of their contract this much? What did this technique do for the future of Best Practice Energy? Read on to find out!

New England Electricity Market Drivers

To fully understand how this client saved over $270,000 on their electricity bills, let’s first quickly overview how natural gas and the weather impacts the price of electricity, specifically in New England.

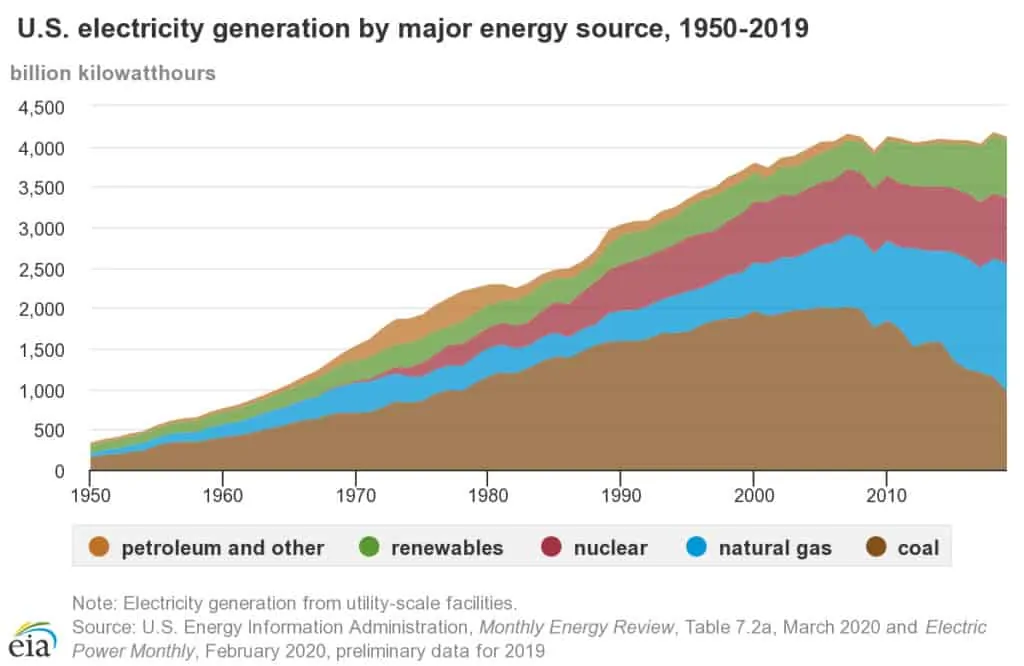

If you’ve read our Energy 101 post on electricity generation, then you know that natural gas is one of the top fuel sources of electricity generation. In fact, natural gas accounted for 13% of all electricity generation in New England in the year 2000, but shot up all the way to 49% in 2015!

This rise in natural gas as a fuel source was in part due to the shale revolution during which the country began the process of fracking to extract extensive amounts of natural gas from the earth.

The sheer amount of available gas from fracking, coupled with new generation and storage technologies, allowed large supplies of gas to be stored and transported throughout the country. This made natural gas a cheaper and more efficient means of electricity generation than oil and coal fired plants.

When natural gas is used as fuel for electricity generation plants, the price generators pay for it gets passed onto the electricity generation they are selling to suppliers and, thus, energy buyers.

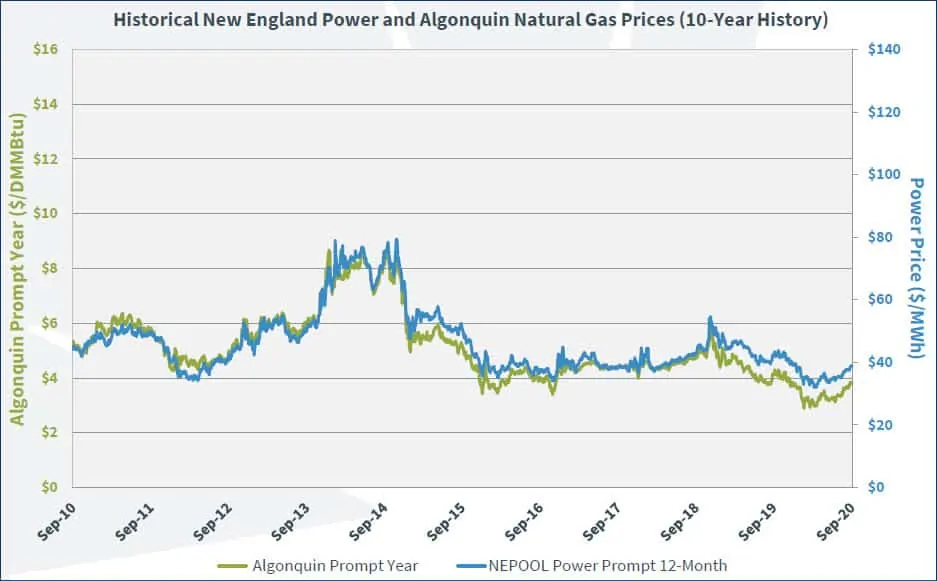

It is no shocking statement to tell anyone from New England that the weather can be erratic. When it gets cold, much of the region relies on natural gas for heating so the demand for it increases. If warm winter days come, the demand decreases, which reduces the price of gas.

Because of this, electricity and gas prices fluctuate with high deltas during the winter. Without an energy consultant who knows how to handle and execute intelligently in the market, this can mean significantly higher bills. However, it also means there is tremendous opportunity to capture market lows if you can play it right.

New England Winters and the Price of Natural Gas

So, how do the winters and natural gas affect the price of electricity? It’s all about simple supply and demand!

The price generators charge for electricity is based on a number of factors. One of the most notable of these is the price they are paying for their fuel source, in this case natural gas.

As demand for gas increases during the cold days in the winter for both heating and electricity generation, more production, drilling and fracking for supply is needed. Because the demand for supply goes up, the price producers charge for it also increases. Electricity generators are then being charged more for the gas source fuel so that price gets passed down to energy suppliers and then energy users!

This is why natural gas storage reports are so important to keep in focus when watching what will happen to the price of electricity and determining when good and bad times to purchase will arise.

The Harsh Winters of New England

Now, back to the story!

The winters in New England can be, in a word, harsh.

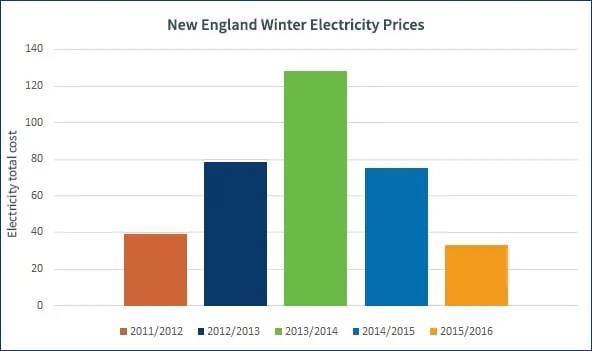

When frigid and cold spells stick around, electricity prices reflect the season’s brutality. When this buyer signed an electricity contract with their incumbent broker in 2013, the average price of electricity during the winter months was 41% higher than in 2012.

Unfortunately for the metal manufacturer, their broker did not strategically purchase the commodity piece of their electricity contract at this time. Instead, they fixed the high price that was available all in for the entire contract term!

Common Contract Missteps

When we looked under the hood of their contract to find out why the winter months were so expensive, we saw the high price they had captured when their first contract began.

This happened because they were not governed by strategy. Their broker grabbed the first price they saw when the contract started and locked it in. As always, the market turned and dropped off shortly after.

When talking to us, the client was not happy with their electricity bills, but they were planning on signing a new contract with their broker as their current one was expiring. They cited that even though they were paying more than they’d like to be, they wanted to sign with their broker because they knew and trusted them.

Through no fault of their own, this energy buyer made two critical errors:

- They mistook trust for strategy and kept signing with their incumbent broker because they had a relationship with them and didn’t know there was a better option

- They waited until right before their contract was up to start purchasing a new one

Customizing a Purchasing Strategy

Seeing all the mistakes their previous broker made, we saw an opportunity to restructure the end of their current contract and start them on a new contract with a sophisticated purchasing strategy. This got us thinking about seasonality and how we could tailor different cost avoidance purchasing strategies to each season.

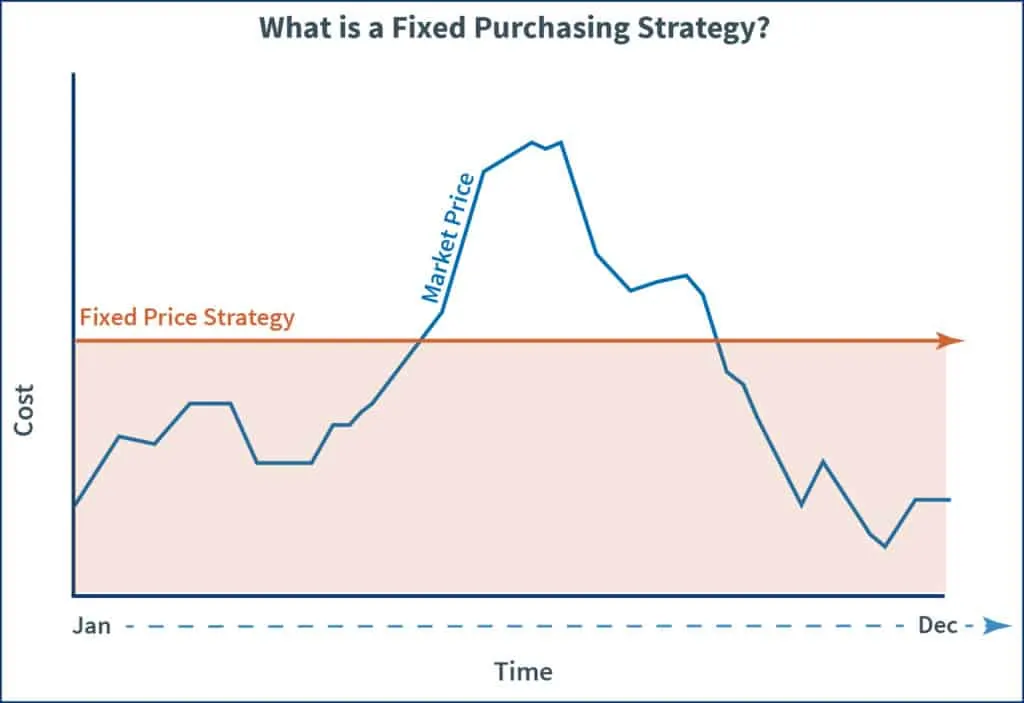

Due to their own budget certainty needs, the manufacturer decided they wanted a fixed price so they could anticipate their energy costs. In line with their request, we locked in the summer, spring, and fall shoulder months in a few different hedges when we saw opportune prices.

We had the conversation with the manufacturer that they would be paying a high price for the prompt winter months of 2014/2015 because those months were so close to their contract start date. We then made a plan with them to not lock in the rest of the winters yet so we could capture lows as the year went on since forecasts were pointing to mild weather in the following winter, 2015.

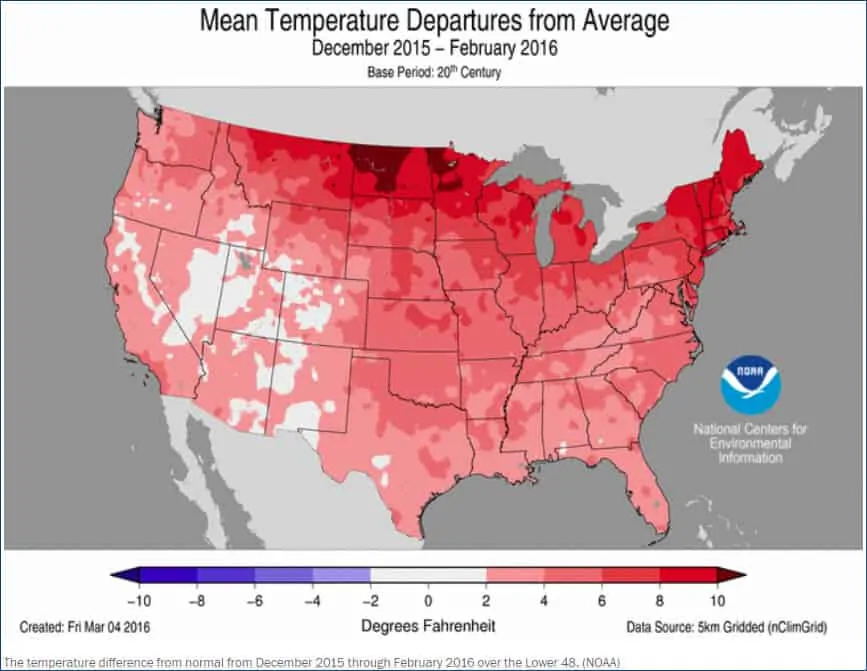

The forecast proved to be correct as December 2015 through February 2016 saw warmer than average winter weather. This allowed us to capture and hedge low prices for future pieces of their contract.

Seasonality Cost Avoidance

All-in-all, customizing a strategy to this manufacturer’s budget needs and facility location ended up helping them achieve $90,000 in cost avoidance per year of their contract, which came out to over $270,000 in avoided costs for the entire contract term!

After experiencing these savings, they began to understand both the importance & advantage of a proactive, strategic approach to procurement. After their new contract was set in stone, we began helping them lock in pieces of their following contract that was 2 years out!

Seeing how much the client saved as a result of this led to a ‘eureka!’ moment for us as well. We began reflecting on taking a seasonality approach to procurement as this was the first time we had tried doing it. We came to the realization that we could both predict and time the market differently each season, which would lead to more effective and tailored cost avoidance strategies.

And so a new type of purchasing strategy was born…

The New Englander Purchasing Strategy

Once our seasonality approach was totally fleshed out, we started implementing and customizing versions of it for our clients based in New England. While the manufacturer of this story didn’t have the budget flexibility to allow for a true blended strategy, many of our other clients in the region did. This is how we developed our New Englander purchasing strategy

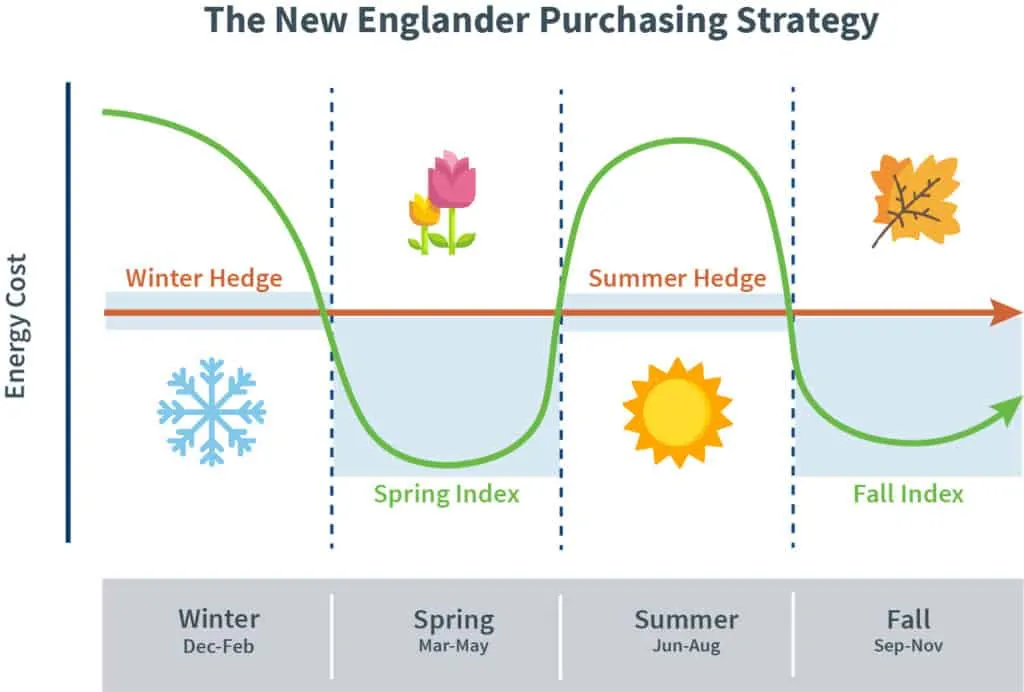

In order to maximize volatility protection and increase opportunities to capture market lows, we most commonly set the New Englander purchasing strategy up like this:

- Lock in the winters and summers due to the volatile weather in both seasons that causes high-low swings of the market

- Float the spring and fall months to capture market dips and valleys

We’ve used customized versions of this strategy for many New England clients over the last 5 years and they have all seen such tremendous success with it that we aptly named it, The New Englander.

This story highlights the importance of a customized strategy and looking at factors such as weather forecasts and the price of natural gas to make the right electricity purchasing decisions.

It also spotlights the differences between energy consultants and brokers!

Working with an energy consultant is more akin to a partnership than the relationship between buyer and broker. We have to work together in order to achieve maximum cost avoidance as every business has different operational, budget, and KPI needs to adhere to.

Our manufacturer client saved over $270,000 over the course of their contract because we worked together to design and implement a purchasing strategy tailored specifically to their needs and location.

This client was not paying too much on their electricity contract because of anything they did other than choosing a broker based on their preexisting relationship. This broker made common mistakes that are the result of outdated & archaic energy procurement methods.

To make sure your broker isn’t making these mistakes, be sure to check out our infographic on the Dos and Don’ts of Buying Energy Intelligently.

Do you think your paying too much on your electricity or natural gas bills? Contact us today to talk to one of our energy advisors who will perform a free consultation to see how much we could help you save in cost avoidance!