On Friday, May 1st, the Trump Administration announced an Executive Order regarding Securing the United States Bulk-Power System.

While this decision was made in response to growing cyber security concerns for the vulnerable US electricity grid, its ripple effect could have broad implications for utilities, power generators, suppliers, and even energy buyers.

What does the Executive Order do exactly?

At a high-level, this Executive Order restricts US power companies from purchasing, installing, importing, or transferring various types of power equipment from specific countries who are deemed as “foreign adversaries”.

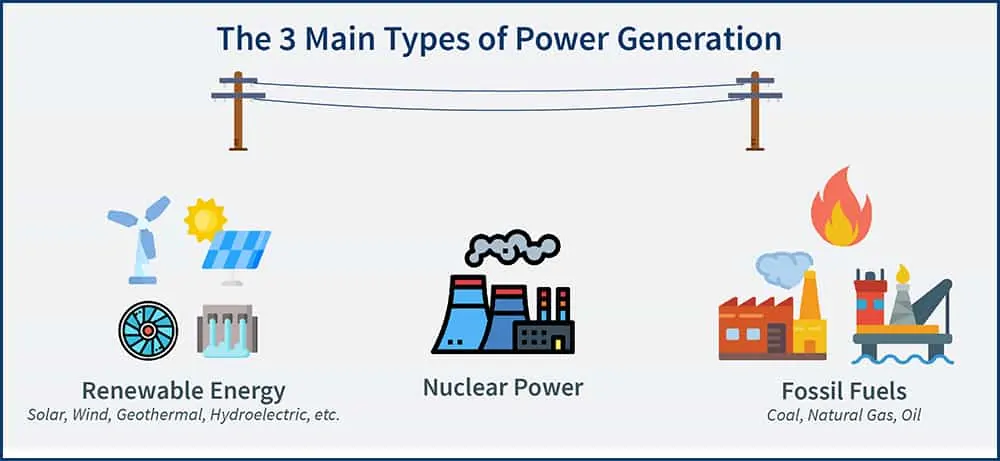

Defined as “bulk-power system electric equipment”, these materials include “control rooms, reactors, capacitors, large generators, substation voltage regulators, instrument transformers, metering equipment, high voltage circuit breakers, generation turbines, distributed control systems, safety instrumented systems” and much more. It is not yet clear which projects will be affected in the short-term and what past projects might be grandfathered in, however, the equipment list referenced in the document is far-reaching throughout the energy industry’s supply chain.

There is no list outlining which countries are considered ‘foreign adversaries’ yet, but the concept is similar to last year’s Executive Order that restricted communications equipment and suppliers from China due to national security concerns.

Is the grid that vulnerable?

While news of cyber attacks on the US’s electricity grid haven’t made the front page recently, there are actually quite a few instances over the last year that have exploited grid vulnerabilities.

In fact, a Siemens Survey reported that over 56% of utilities have dealt with a cyber attack within the past year and 4% even had over 10 situations in that same time frame! These attacks range all the way from email phishing attacks to more nefarious ones that could’ve potentially caused a lot of damage. A quarter of respondents also say they’ve been affected by what are described as ‘mega attacks’ that targeted weakened entry points within the complex utility networks.

With everything revealed in the Siemens Survey, it does seem that the grid has been a prime target for both small-time hackers as well as more sophisticated and skilled foreign invaders. The question is, how will this impact other aspects of the energy industry?

Who could be affected?

The energy industry is extremely complex and has a very complicated supply chain for the sourcing and creation of equipment. This chain is so complex that a single deployment involves an abundance of OEMs (Original Equipment Manufacturers), subcontractors, hardware & software assemblies, and a variety of other components from multiple sources!

Once the terms of this Executive Order are fully established, the most affected will be the utilities, generators, and suppliers as they will have to begin sourcing their equipment for projects from new manufacturers. Depending what this new supply chain landscape looks like, these market participants may be looking to American-based factories to purchase new equipment, which could cause a spike in prices.

Others who will be feeling the effects of this will likely be renewable energy projects as they will also be looking for new sourcing methods as well as dealing with more bureaucratic red tape to vet manufacturers, which may result in delayed deployment timelines.

What does all this mean for the average energy buyer?

Because this Executive Order is very new, it does raise a number of questions and leave a few details ambiguous, all of which should be answered in due time.

This is not our first rodeo so any time we hear about any sort of legislative changes coming down the pipeline, we do our homework and ruminate how they could potentially affect our clients’ energy contracts.

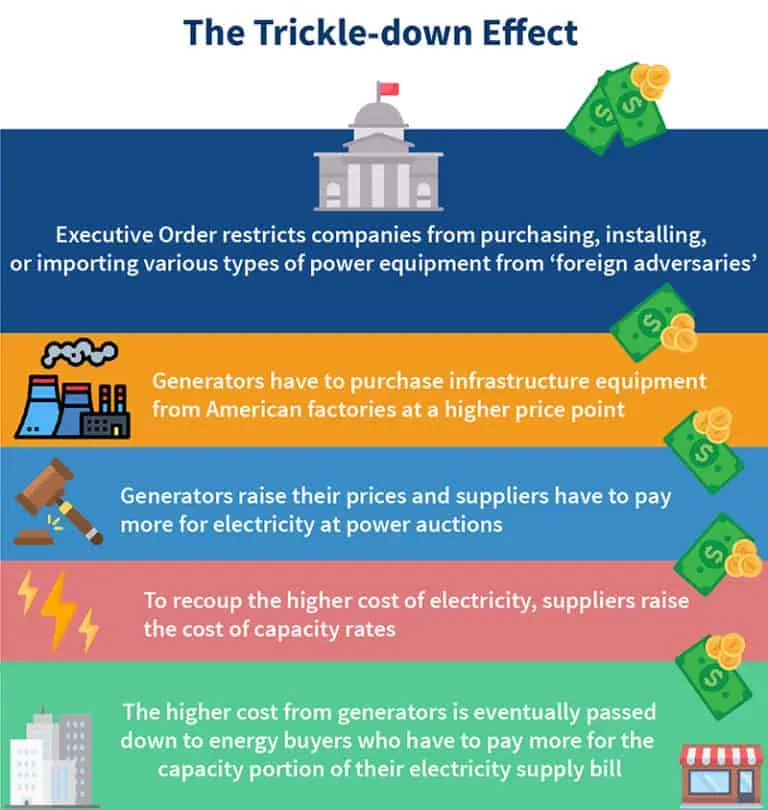

Our first question is, if this equipment must now be made in the US, will it be more expensive? As we’ve seen over the last few years, US factories do tend charge more for manufactured products. If this cost is realized, will it, along with longer approval processes, be passed down to the average energy buyer?

In simple, high-level economic terms, it would make sense that if generators are paying more for equipment that they would need to recoup that cost somewhere else so they would likely raise their prices. Because suppliers purchase their energy 3 years in advance at auction with these generators (some suppliers have their own generation units), the new cost of electricity generation would be passed onto them. So, in this scenario, if the suppliers are paying more for their energy, the cost could trickle down to energy buyers and bring an uptick to capacity costs.

The same would go for utilities: if it costs more to build infrastructure and timelines are elongated, they would be looking to recoup some or all of this new cost from suppliers and, thus, energy buyers.

With all that said, there is a tremendous amount of uncertainty with this entire situation so we’re just speculating at what the potential ramifications could be. However, we will be following this new legislation and, if we suspect any pricing changes to come as a result, we will be sure to update this story and keep our clients in the loop.

The hard truth of the matter is that even if this Executive Order doesn’t affect capacity rates, the cost of electricity price components will increase at some point. Just look at what happened in Massachusetts when new legislation threatened to raise the price of Renewable Portfolio Standards (RPS). As soon as we saw this legislation, we helped our clients lock in their future RPS costs at the right time to insulate them from the coming increases.

The point is this: energy is an exceedingly complex and constantly changing industry, but it’s one that is a lot easier to navigate and take advantage of when you have a partner that keeps an eye on legislation, knows the ropes, and is skilled at taking advantage of situations as they arise. Contact us today to discuss locking in a future contract using our strategies and what your business could save in cost avoidance as a result.