Renewable Portfolio Standards are a state-regulated component of an energy supplier’s price.

The Renewable Portfolio Standards (RPS) component of your electricity bill requires a percentage of the electricity supply load to be generated from renewable resources. These standards help diversify energy resources, promote domestic energy production, and encourage economic development.

When a state increases their RPS requirements, suppliers increase costs. This is because the RPS price component takes up a larger percentage of their total energy price.

In 2018, legislation was passed in Massachusetts increasing clean energy standards, which increased the electricity supply’s RPS requirements. News of this new legislation sent up a huge red flag for our energy advisors. We knew we needed to act quickly to ensure our client’s electricity contracts were insulated from this incoming volatility.

What Happens When Renewable Portfolio Standards Change

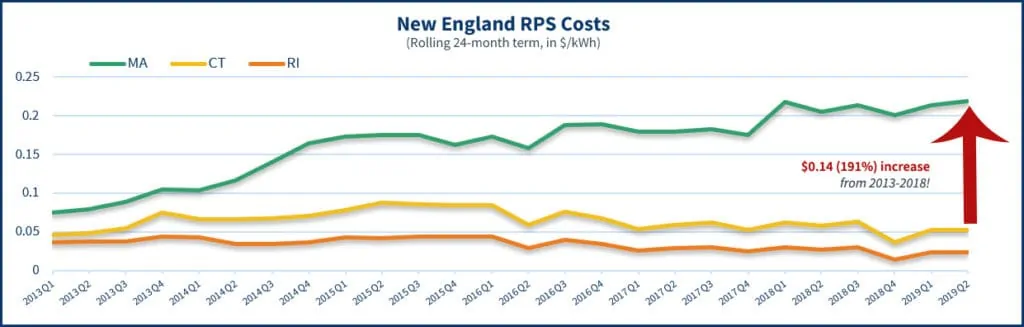

We examined the law closely and did a historical analysis on RPS costs in New England. We then made a predictive model that forecasted these gains from 2018 through 2019. This analysis revealed prices were likely to have a $0.14 per kWh increase from 2013 through 2019 and would continue to inflate in the future. $0.14 may not seem like a lot, but that’s a 191% increase over 6 years (figure 1)!

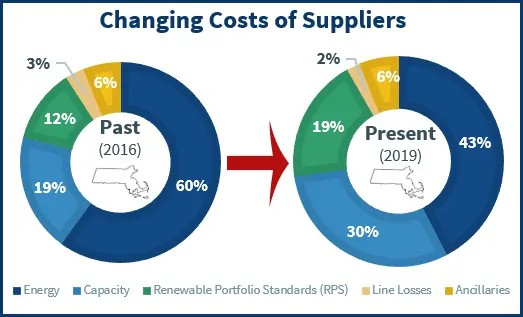

To paint a complete picture of how this would affect our clients, we also examined the RPS percentage of Massachusetts suppliers’ prices. In 2016, RPS accounted for just 12% of a supplier’s price. By 2019, we discovered this was projected to rise up to 19% (figure 2).

In an effort to ensure our customers were not hammered by these incoming costs, we meticulously combed through the legislation. We identified some language embedded in the bill that indicated if a business were to lock in the RPS component of their contract by the end of 2018, their future energy contract was exempt from these new costs.

We immediately notified our clients and worked around the clock to lock in the RPS portion of their contracts. In many cases we even extended contract lengths to maximize their volatility protection as far out as 8 years.

The Aftermath

Quickly locking in RPS price components before the deadline ended up saving our clients several millions in cost avoidance.

Other states across the country are not immune to these types of circumstances. In 2019, New Hampshire, Maine, and Maryland all dealt with similar legislation. It is likely just a matter of time before legislation like this impacts other deregulated energy states. This presents opportunities for energy buyers to get out in front of the pack and protect their contracts.

Contact us today to find out if your state is on our radar for new RPS legislation and if we think it’s a good idea to lock in the RPS component of your energy contract.